November 01, 2021

BANKING ON MUM AND DAD

There are three things that have characterized the Canadian residential housing market in 2021: the acute national supply shortage, low interest rates, and strong ongoing demand. Small wonder that according to the Canadian Real Estate Association (CREA), the actual national average sale price was up almost 14 per cent in September, year-over-year.

Faced with such hurdles to homeownership, almost two million Canadians – or about nine percent of the population aged 25 to 64 – lived with their parents in 2017, according to Statistics Canada. That’s double the number in 1995.

The joys of having your kids under your roof indefinitely may provide valuable context for an economic trend recently reported by CIBC deputy chief economist, Benjamin Tal.

In a new study, he reveals that Canadian parents gave their adult children about $10 billion toward the down-payment on a home over the past year. Just under 30 per cent of first-time buyers got an average $82,000 from the Bank of Mum and Dad. It’s up significantly from 2015, when the average parental contribution to 20 per cent of first-time buyers was $52,000.

You get the details on the report here.

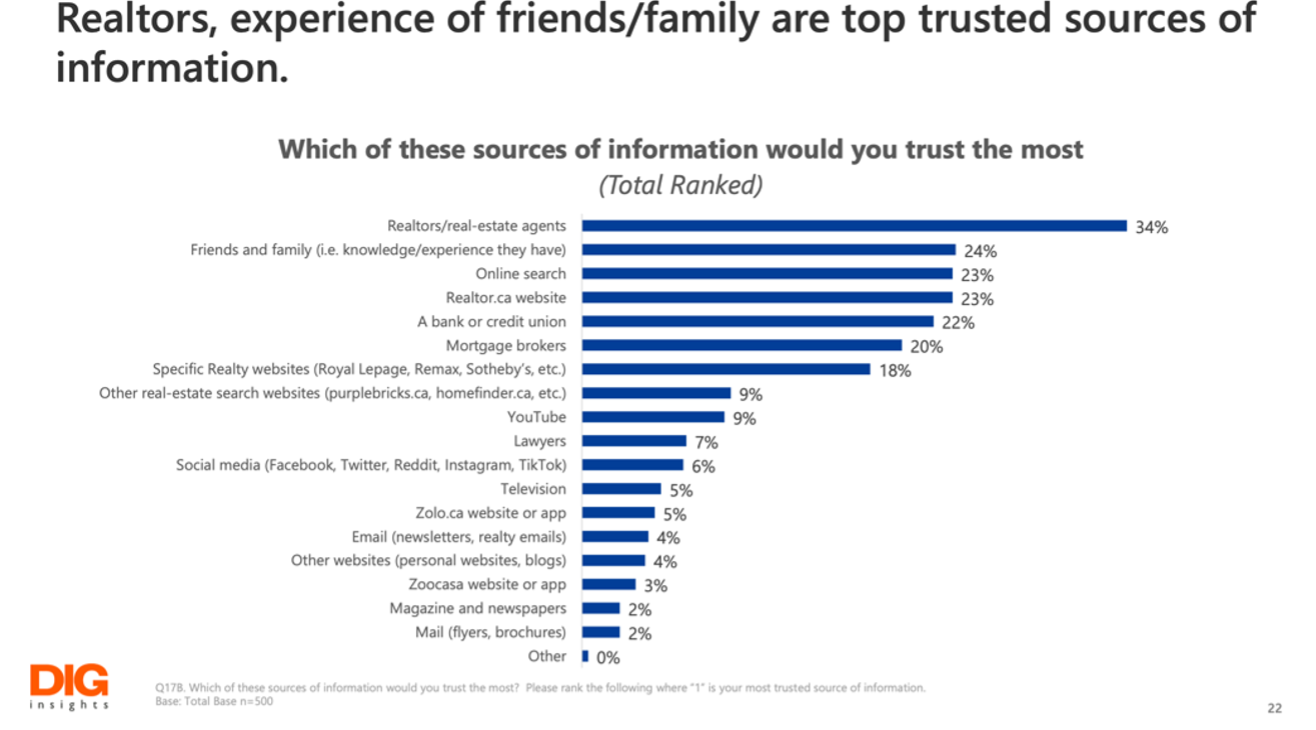

When it comes to navigating such a complex residential real estate market, it’s worth noting that Canadians are turning to realtors for professional guidance. Ourboro, a Peerage Realty partner company that provide down-payment financing for first-time buyers, recently undertook market research that clearly demonstrated the value of trusted advisors when it comes to buying a home.

Ourboro

Real Estate Services

|

Locations Canada |

Services Investment Services |

Read More

Ourboro is a private, Toronto-based company dedicated to unlocking home ownership for Canadians. It does this by providing up to $250,000 toward the down payment on a home, provided the buyer has saved at least five percent of the 20 per cent required to obtain an insurable first mortgage. In exchange, Ourboro becomes a a long-term equity stake in the property. Although it plans to strategically expand across Canada over time, Ourboro is currently focusing on the Greater Toronto Area (“GTA”) where the average gap between down payment and savings is $125,000. It has partnered with Peerage Realty Partners, to help make the dream of home ownership a reality for Canadians.

1325 Lawrence Avenue East, Suite 200, Toronto, ON M3A 1C6

Peerage Realty Partners is a subsidiary of Peerage Capital Group.

1325 Lawrence Avenue East, Suite 200, Toronto, ON M3A 1C6

Peerage Realty Partners is a subsidiary of Peerage Capital Group.